B.C. introduces law to prevent money laundering, tax evasion in real estate

VICTORIA — British Columbia has introduced legislation for Canada’s first public registry of property owners to prevent hidden ownership in an effort to stop tax evasion and money laundering.

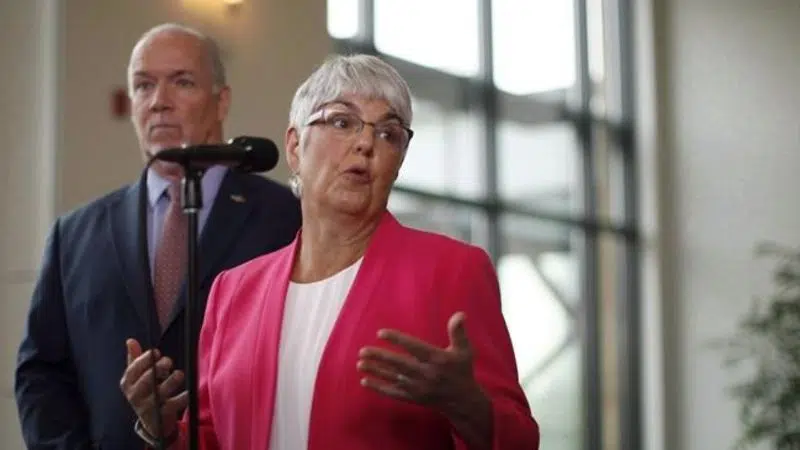

Finance Minister Carole James says the proposed Landowner Transparency Act would require corporations, trusts and partnerships, which currently own or buy land, to disclose their beneficial owners.

She says the legislation is part of the government’s housing strategy to close real estate ownership loopholes and crack down on property speculation, tax evasion and money laundering.