Liberals sidestep NDP call to close stock option tax loophole

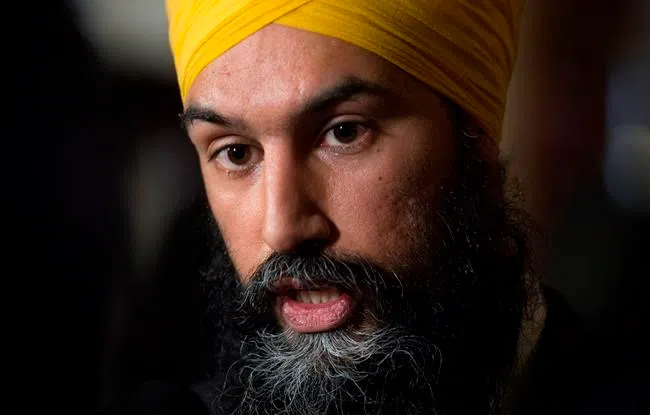

OTTAWA — Federal New Democrats are trying to pin down whether the Trudeau government plans to fulfil or abandon its pledge to close a controversial tax loophole, which critics say primarily benefits CEOs and other senior executives.

The Liberals made the promise to clamp down on what are known as stock-option deductions during the last election, but have remained ambiguous about their intentions since taking power more than two years ago.

It was in that context that the NDP, which had also promised to act against the deductions, tabled a motion Thursday calling on the government to make good on its promise in the coming federal budget. It will be put to a vote next week.

The Liberals supported a similar motion last March, but it did not contain a specific timeline for implementing the motion, which also urged the government to clamp down on tax havens.