Teeing up for tax season

Tax season is here.

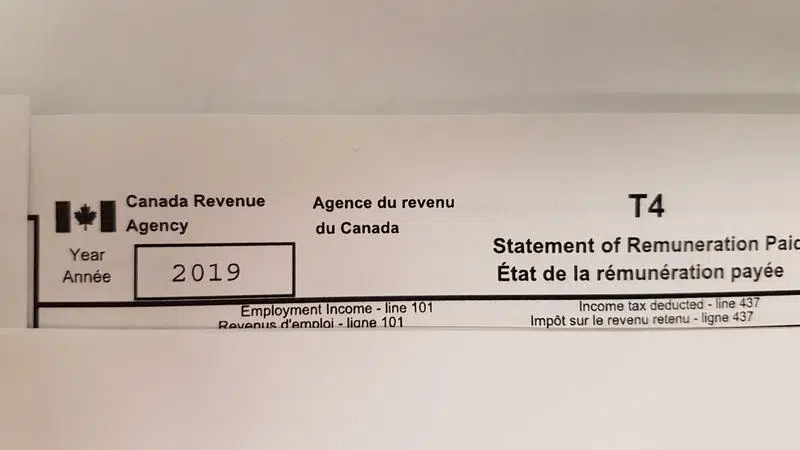

If you haven’t already received your T4 forms from your employer, they should be provided by the end of February. For those who receive investment income, those forms should be received by the end of March. The final day to file taxes is April 30.

Courtni Penner is the manager at MNP in Melfort and said some people may not feel like they need to do their taxes, whether they don’t make a lot of money or otherwise. She said it’s important for people to know why it’s necessary.

“There are GST credits, and the Canadian Child Benefit to think about, so even if you don’t pay tax, you might be eligible for some credits from filing,” Penner told northeastNOW. “It’s also important because if you have paid tax, you might have overpaid and you might be eligible for a refund.”